And then you'd repeat that process for all of your accounts. In the old YNAB, you'd log in to your bank account, download your transaction file, go back to YNAB, initiate the import, locate your downloaded transaction file, preview the import, make sure it was going to land in the right account, and then click the import button. With the latest edition, YNAB has been rebuilt from the ground up. YNAB’s last version was YNAB 4, which was a desktop-based application. YNAB (see our review) is an app that provides both the mechanics of monitoring your income and expenses and instructional support to help you deal with the root causes of financial distress. It’s easy to sign up for alerts to be sent via email or directly to your smartphone for: Mint keeps an eye on your money so you don’t have to. The software presents your financial information in a slick, easy-to-use web interface, with information and pretty graphs on a user-friendly dashboard.

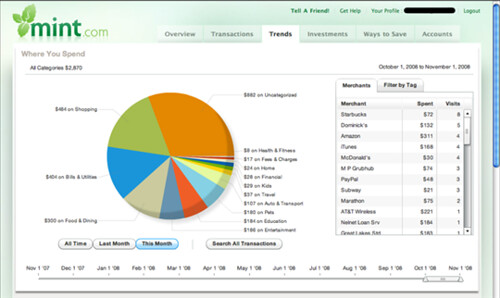

With Mint, every time you visit the site, your financial data gets updated automatically. Once set up, Mint will remember repeating transactions so it will automatically match the same category in the future. While you can’t modify the top-level categories, you can create and add your own subcategories. After downloading and syncing your transactions, Mint’s software automatically separates them into predefined categories. At initial setup, you can add all your accounts in a pretty seamless download process. The platform incorporates all of your financial accounts - bank, investment, credit cards, and loans - into one place and provides a big-picture view of your entire financial situation. While Quicken used to be Intuit’s lead product, Mint has become their sole focus since announcing the sale of Quicken. The Mint app was started in 2006 and was acquired by Intuit in 2009. As such, it’s accessible with any browser or mobile device. Mint (see our review) is a free online personal finance service similar to Quicken, but without any software to install.

Should ADRs Be Added to Your Portfolio?.How to Know If a Company or Fund Is Really ESG.How to Invest 50k: The Best Place to Invest Money Right Now.How to Invest $1,000: 8 Best Ways to Invest Right Now.

0 kommentar(er)

0 kommentar(er)